By Tim Parle

Towards the allocation of High Demand Spectrum in South Africa

July 2016 marks a possible massive step forward in the allocation of spectrum from 4G and 5G aications in South Africa. The path to reach this point had been long and difficult. Are we finally in a position to provide the spectrum "oxygen" that our wireless broadband market demands? Is it time to 'shoot the engineer and start production'?

The last 10 years

The telecommunications sector in South Africa has experienced start-stop progress in the allocation of high-demand spectrum with ICASA's processes having started as early as November 2006. Numerous discussion documents and proposals have been mooted, hearings held, and deadlines set and broken.

Some progress was evident at the end of August 2014 when ICASA released the Draft Information Mobile Telecommunications (IMT) Roadmap for Consultation via a Government Gazette. ICASA subsequently published an "Information Memorandum" in September 2015 providing guidance to prospective applicants regarding the process and criteria to be applied by in the licensing process. The industry was largely taken surprise by the publication of these documents.

Progress in 2016

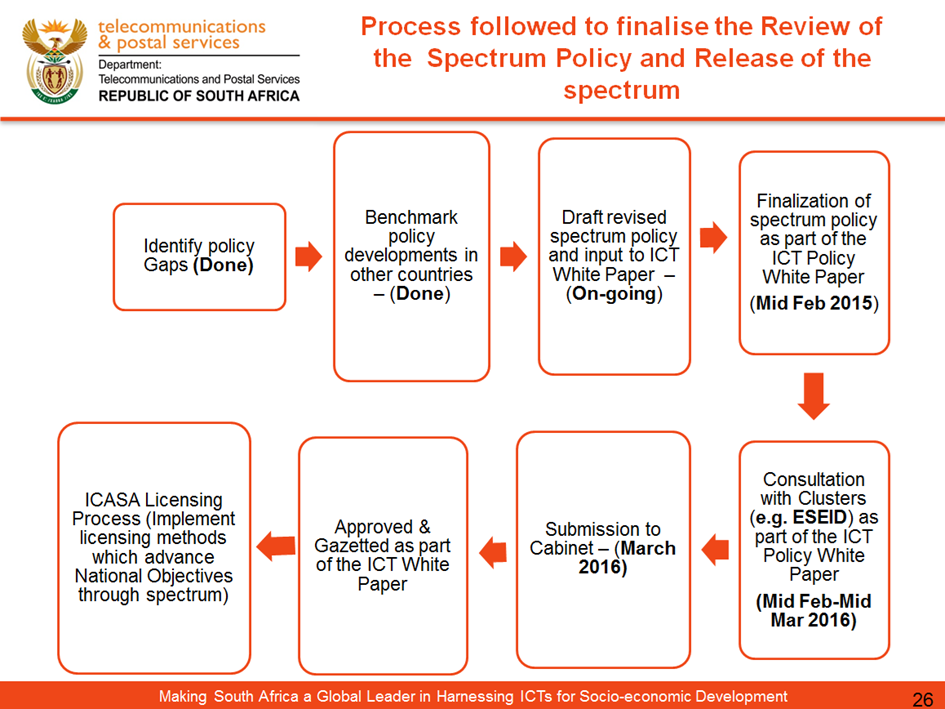

In February 2016, as part of the Department of Telecommunications and Postal Services' (DTPS) presentation to the Portfolio Committee for Radio Frequency Spectrum Policy and Regulations, it appeared that the long awaited White Paper of ICT would finally surface, and that finalisation of the spectrum policy would follow in the same month. From this plan presented it was expected that the next logical move was for the DTPS to publish the White Paper on ICT, engage in some consultation with stakeholders, and gazette the Spectrum Policy and the process for the release of spectrum.

Source: DTPS, Presentation to the Portfolio Committee: Briefing on spectrum policy and processes moving forward, 16 February 2016

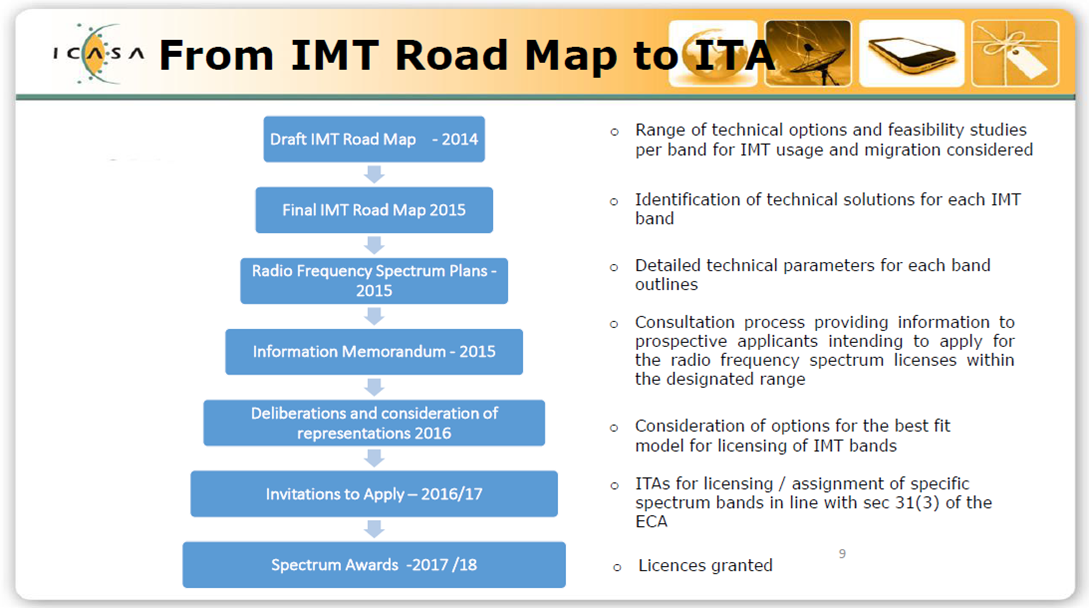

At the same session, in ICASA's presentation, the Authority put forward a roadmap showing the steps already taken and those anticipated towards the final assignment of the high demand spectrum to operators. There appeared to be progress and alignment, and light at the end of the tunnel for the release of the spectrum so badly needed in the industry.

However, this plan was not followed and the draft White Paper is still to see the light of day. ICASA made the next move when on 15th July 2016 they published the Invitation to Apply for a Radio Frequency Spectrum Licences to Provide Broadband Wireless Access for Urban and Rural Areas using the Complimentary (sic) Bands, 700MHz, 800MHz and 2.6GHz. This was again, unexpected although TechCentral had reported only the day before that "South Africa is poised to start the process of selling broadband spectrum after a delay of several years, according to sources". Their sources are not identified, and it certainly appears that officials outside of ICASA were caught by surprise.

Review of the ITA

The publishing of the ITA has been seen as a welcome move. The central factor in the document is the table of "Lots" in the 700MHz, 800MHz and 2600MHz bands. The bandwidths are as shown below.

| Lots | 700MHz | 800MHz | 2.6GHz |

| Lot A | 2 x 15MHz | - | 2.5MHz |

| Lot B | 2 x 5MHz | 2 x 5MHz | 2 x 20MHz |

| Lot C | - | 2 x 10MHz | 2 x 20MHz |

| Lot D | - | 2 x 10MHz | 2 x 20MHz |

| Lot E | 2 x 10MHz | - | 2 x 10MHz |

The following observations have been made:

- Harmonization: The bands align with those auctioned in France, the UK and other countries in recent years. They allow the most popular frequencies worldwide to be used, allowing us to benefit from the economies of scale of global standards.

- Mix of technologies: The band plan allows for a mix of TDD and FDD approaches to be used. This is important as there is no clear winner between these two approaches.

- Lot A provides the lion's share of the digital dividend spectrum in a standard LTE band and is "to be awarded through a separate process". Those participating in the bidding will certainly want to know more about the intended use of this valuable spectrum. Although not explicitly stated in the ITA, previous documentation showed that this would be reserved for a WOAN (Wireless Open Access Network). The Information Memorandum also had a Lot E but this is subsumed into the new Lot A.

- Lot C and D have similar allocations in the 800MHz and 2600MHz band. These are certainly very attractive to the incumbent operators. These are the same as those detailed in the Information Memorandum, and hence provided no surprises to the bidders.

- Lot B has narrow allocations in the 700MHz and 800MHz bands which will impact on the channel bandwidths used. These may be too narrow and restrictive to offer high speed services (particularly with the 15Mbps requirements specified in the ITA). This is also a change from that detailed in the Information Memorandum.

- Lot E has the benefit of a mid-sized allocation in the 700MHz band and a small allocation in the 2.6GHz band.

- The division of the TDD section of the 2.6GHz band into 4 x 20MHz and 1 x 20MHz seems to match the current market requirements of four operators plus the introduction of one more.

- The requirement to offer open access to a minimum of three MVNOs is a curious new angle. There is no element of scale related to this. It is no doubt intended to bring new operators into the market.

- The timetable for the auction looks rigorous.

- The requirements for the R3 million application fee and R100 million guarantee show that this is a game which will have a few players. This is particularly true when considering the R3 billion reserve price. Cell C have already raised a concern about the latter.

There are many other areas in the ITA that bear a detailed reviewed and criticism. There are also many areas that are contentious, and no doubt the regulatory lawyers are already developing their lists of issues. Overall one can only hope that the process progresses and that the publishing of this document has spurred the DTPS into action, and that the industry will utilise this opportunity to progress wireless broadband access for all. Perhaps the old adage can be adapted to read "In every project there comes a time to shoot the lawyers (rather than the engineers) and start production"?