By Tim Parle

Out of the blue - the SITA Broadband Connectivity tender

During the 2015 State of the Nation Address (SONA), President Zuma announced that the government had "decided to designate Telkom as the lead agency to assist with (the) broadband roll out". The industry was blind-sided with this announcement that came 'out of the blue'. In the months that followed the SONA, comments provided by the Minister and the Deputy Minister of Telecommunications and Postal Services in public addresses generally defused, diluted or otherwise explained the statement, and over time this label of 'lead agency' has faded away.

In late June 2016, again in an unprecedented move, SITA floated tender RFB 1439/2016 for the "Appointment Of A Service Provider For The Provisioning Of Broadband Connectivity". Has SITA have taken over the mantle as 'lead agency'?

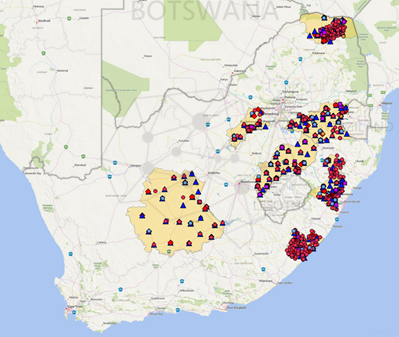

Per the tender, the appointed service provider will be required to build and operate broadband access services in the eight district municipalities identified for Phase 1 implementation of the SA Connect programme connecting 6,135 identified government facilities. The tender states that "broadband access services will connect to the existing Government private network that is operated by SITA and will enable access to Government application services hosted at SITA and to the internet". The figure below shows the distribution of these facilities. 75% of these are schools, and curiously include some of the leading private schools in the country.

The closing date was set as the 18 July 2016 and a compulsory tender briefing was held in the SITA auditorium. The venue was full to capacity with prospective bidders, eager to find a role in moving the business of broadband and Internet access forward. The submission was later extended to the 8th August 2016.

Commentary

There are several requirements in the tender that severely restrict the number of players that will be in a position to directly compete for the tender. Many or indeed most of those at the briefing hoping to get a piece of the action are likely to be excluded from the tender. In essence, SITA is looking for a large, well-resourced and experienced party with the technical, managerial and financial muscle to satisfy the specifications of the network. Conversely, and disappointingly, they are not looking to develop or empower regional or emerging players, or encourage competition within the programme. On inspection, their focus may even be on a single market player. Factors that inform this view are:

a) The bidder must already be providing broadband services to 2,500 business or Government sites with different physical addresses. On these, at least 50% must be connected with fixed lines (wire or cable).

b) The bidder must have delivered on a project or projects within a minimum period of 36 months that connected at least 2,500 business or Government customer sites with data connectivity.

c) Evidence of the performance of these sites must be provided for the preceding 24 months.

d) The bidder must demonstrate that it has an unencumbered cash balances of no less than R370 million. (Comment: a large but seemingly random amount)

e) A design must be produced and 2700 sites have to be completed within 14 months after signing the contract. (Comment: this means that a significant amount of fixed infrastructure needs to be in place already)

The project calls for more than just the broadband connectivity that the tender's title suggests. The requirement is for a fully managed Layer 3 solution plus 802.11ac Wi-Fi access at each site. Effectively this is a large enterprise network - 2,500 sites is a pretty big enterprise network, be it wired or wireless. To put this into perspective, there are around 1,500 PEP stores, and a total of 4,300 ABSA ATMs & branches across South Africa, so the overall network would be even bigger than that of these two enterprises combined. Also, for PEP an ABSA most sites are located in cities and towns, and not in deep rural locations. The degree to which this is a problem varies across the country - for example, for the 1,500-odd sites identified in the Free State (Thabo Mofutsanyane municipality) and Mpumalanga (Gert Sibande) over 90% of the sites are fairly close to the towns, while quite the opposite is apparent for the sites in the OR Tambo municipality in the Eastern Cape, uMzinyathi municipality in KwaZulu-Natal and the Vhembe municipality in Limpopo.

An important requirement in the tender is that the bidders must be providing the Electronic Communications Network Services (ECNS) that deliver the data connectivity for the 2,500 existing sites. This might be interpreted that a bidder providing MPLS services over Telkom Diginet or Telkom MetroClear or MetroLAN to the client cannot count these in their tally - only Telkom can claim that connection as they own and operate the access infrastructure. Similarly, extension of the logic rules out the provision of any services over ADSL, VDSL or SHDSL as technically only Telkom provides these. The 'get out clause' is that if the bidder can demonstrate that it provides services to at least 1,251 (50% plus one) facilities over wireless and they have an installed base exceeding 2,500 then they can still qualify. Also, the question of if a bidder provides services to clients over leased dark fibre, whose ECNS licence is in play is also moot. Even with these 'work arounds' the field widens to include others such as Vodacom, MTN, Neotel, Dimension Data / Internet Solutions and / or Cell C, but few beyond this.

Yes overall the launch of the tender is a positive move but the execution is perhaps flawed. Partnerships, joint ventures, sub-contracting and other creative models might allow others to compete, but overall the tender is weighted towards a single source of supply. In the long run, appointing a single player may not be not healthy - a regional split, or perhaps appointing two winners with active and ongoing competition per area might have produced a better outcome for the country. It will certainly be fascinating to see how this all pans out. We have seen announcements related to SA Connect come out of the blue, and perhaps there are more to come?